When it comes to safeguarding your home, car, and financial future, Amica Insurance is a name that stands out for its exceptional customer service and comprehensive coverage options. If you’re exploring your insurance options, obtaining an Amica home and auto insurance quote could be the first step toward securing reliable protection tailored to your needs. This guide provides a deep dive into everything you need to know about Amica’s offerings for 2024-25.

Introduction to Amica Insurance

Founded in 1907, Amica Mutual Insurance Company is one of the oldest and most reputable insurance providers in the United States. Known for its commitment to customer satisfaction, Amica consistently ranks high in customer reviews and industry ratings. The company specializes in home, auto, and umbrella insurance, offering personalized coverage options and competitive pricing.

Why Choose Amica for Home and Auto Insurance?

Amica stands out for several reasons:

- Bundling Discounts: Amica offers substantial savings when you combine home and auto insurance policies.

- Exceptional Customer Service: The company is renowned for its hassle-free claims process and quick resolutions.

- Customizable Policies: You can tailor coverage to fit your unique needs and budget.

- Financial Stability: Amica’s strong financial ratings ensure reliability in paying claims.

Amica Home Insurance: Key Feature

Amica’s home insurance policies provide protection against a wide range of risks. Here’s what you can expect:

- Dwelling Coverage: Protects the structure of your home from covered perils like fire, storms, and vandalism.

- Personal Property Coverage: Covers your belongings, including furniture, electronics, and clothing, against theft or damage.

- Liability Protection: Shields you from financial losses if someone is injured on your property.

- Additional Living Expenses (ALE): Pays for temporary housing if your home becomes uninhabitable due to a covered event.

Optional Add-Ons:

- Water backup and sump pump overflow coverage.

- Earthquake or flood insurance (varies by location).

- Valuable items coverage for high-value belongings like jewelry or antiques.

Amica Auto Insurance: Key Features

Amica’s auto insurance policies are designed to offer maximum protection on the road. Core features include:

- Liability Coverage: Covers bodily injury and property damage caused to others in an accident.

- Comprehensive and Collision Coverage: Pays for damages to your car, whether due to accidents, theft, or natural disasters.

- Uninsured/Underinsured Motorist Protection: Covers your expenses if the at-fault driver lacks adequate insurance.

- Roadside Assistance: 24/7 support for breakdowns, flat tires, or towing.

Optional Add-Ons:

- Accident forgiveness.

- Rental reimbursement coverage.

- Gap insurance for leased or financed vehicles.

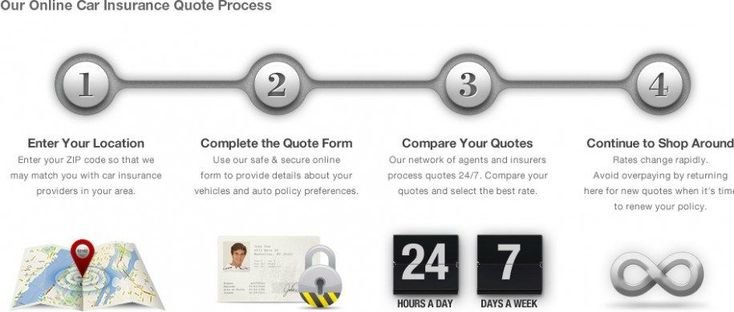

How to Get an Amica Home and Auto Insurance Quote

Obtaining a quote from Amica is a straightforward process. Here’s how:

1. Online:

- Visit Amica’s official website.

- Navigate to the “Get a Quote” section.

- Provide details about your home, vehicle, and personal information.

- Review your coverage options and customize your policy.

2. Phone:

Call Amica’s customer service at their toll-free number to speak with a representative. They can guide you through the process and provide personalized recommendations.

3. Local Agent:

For a more personalized touch, visit an Amica branch near you to discuss your options with an agent.

What Affects Your Amica Insurance Quote?

The cost of your Amica home and auto insurance quote depends on several factors:

- Home Insurance:

- Location and home value.

- Age and construction type of the property.

- Coverage limits and deductibles.

- Security features like alarms or fire sprinklers.

- Auto Insurance:

- Driver’s age and driving history.

- Vehicle make, model, and year.

- Annual mileage and primary use.

- Credit score and location.

Tips for Lowering Your Amica Insurance Costs

- Bundle Your Policies: Combine home and auto insurance for a significant discount.

- Improve Your Credit Score: A better credit score often leads to lower premiums.

- Install Safety Features: Equip your home with smoke detectors or your car with anti-theft devices.

- Increase Deductibles: Opting for a higher deductible can lower your monthly premiums.

- Maintain a Clean Driving Record: Avoid traffic violations to keep auto insurance costs down.

Amica’s Discounts and Rewards

Amica offers a variety of discounts to help customers save money:

- Multi-Policy Discount: For bundling home and auto insurance.

- Loyalty Discounts: For long-term policyholders.

- Claims-Free Discount: For customers with no recent claims.

- Safety Features Discount: For vehicles with anti-lock brakes or homes with advanced security systems.

Customer Reviews and Ratings

Amica is consistently praised for its:

- High Customer Satisfaction: Amica has received top ratings from J.D. Power for its customer service and claims satisfaction.

- Transparent Pricing: Policyholders appreciate the clarity in coverage details and pricing.

- Fast Claims Process: Amica ensures timely payouts for covered claims, making it a favorite among its customers.

Amica vs. Competitors

Here’s how Amica compares to other insurance providers:

| Feature | Amica | State Farm | Geico |

|---|---|---|---|

| Customer Service | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Bundling Discounts | Up to 25% | Up to 17% | Limited |

| Claims Satisfaction | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐ |

| Customization | High | Medium | Low |

Conclusion

For 2024-25, Amica home and auto insurance continues to be a top choice for individuals seeking comprehensive coverage, excellent customer service, and competitive pricing. Whether you’re a first-time buyer or looking to switch providers, getting a quote from Amica can be the first step toward peace of mind and financial security.

Don’t wait—explore your options with Amica today and take advantage of their customizable plans and bundling discounts. Protect what matters most with one of the most trusted names in insurance.

FAQs About Amica Home and Auto Insurance

1. Is Amica a reliable insurance company?

Yes, Amica has been rated highly for customer satisfaction and claims handling.

2. Can I bundle home and auto insurance with Amica?

Absolutely! Amica offers significant discounts for bundling multiple policies.

3. Does Amica provide coverage in all states?

Yes, Amica operates nationwide, though some coverage options may vary by state.

4. How long does it take to get an Amica insurance quote?

The online process takes only a few minutes, while phone consultations might take longer for detailed discussions.

5. Are Amica’s policies expensive?

Amica’s prices are competitive, and their numerous discounts can make coverage more affordable.

Feel free to contact Amica for a personalized quote and see how they can meet your insurance needs for 2024-25.

Leave a Reply